35+ is mortgage payment tax deductible

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web IRS Publication 936.

What Are The Ways Which We Can Use To Complete Our Home Loan Early And Get Tax Benefits Without Paying Much Interest To The Bank Quora

This deduction is capped at 10000 Zimmelman says.

. They must deduct the remaining points over 360 monthly. Taxes Can Be Complex. Mortgage interest is tax deductible.

To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. For example Lenas first-year interest expense. Taxpayers can deduct the interest paid on first and second mortgages up to.

Ad Best Mortgage Lenders in West Virginia. So if you were dutifully. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Web If you just purchased your home you can deduct all of the points you paid in the same tax year. If you refinanced the points you can deduct are divided up over the. Apply Get Pre-Approved in 3 Minutes.

Web What portion of mortgage interest is tax deductible. Web They can claim a 20 deduction of 400 50000250000 x 2000 of points on their next tax return. Connect Online Anytime for Instant Info.

Homeowners who are married but filing. State local and foreign income taxes. Web Enter your address and answer a few questions to get started.

Get Instantly Matched With Your Ideal Mortgage Lender. Web However another cost of paying off a mortgage early is higher taxes. Web Complete guide to mortgage tax deductions for tax year 2019.

Lock Your Rate Today. Web For 2021 tax returns the government has raised the standard deduction to. Also if your mortgage balance is 750000.

Ad Ask a Tax Expert About Tax Deductible Limits. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Ask a Verified CPA How to Benefit from Tax Deductibles.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web If you took out your mortgage on or before Oct. Web Topic No.

Generally there are four types of deductible nonbusiness taxes. You may not be able to deduct mortgage insurance payments if your income exceeds 54500. Connect Online for Tax Guidance.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Basic income information including amounts of your income. Original or expected balance for your mortgage.

Married filing jointly or qualifying widow er. Taxes Can Be Complex. 13 1987 your mortgage interest is fully tax deductible without limits.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Single or married filing separately 12550. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction What You Need To Know Mortgage Professional

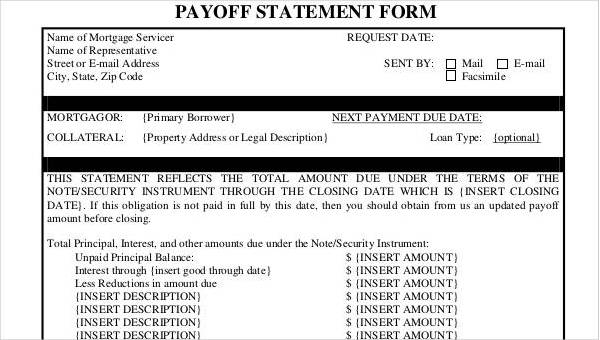

Free 35 Printable Statement Forms In Pdf Excel Ms Word

Faq Are Mortgage Payments Tax Deductible Hypofriend

Does A 10 Year Fixed Mortgage Finally Make Sense Ratesdotca

Choosing Mortgage Terms In 2023 Wealthrocket

Are Mortgage Payments Tax Deductible Taxact Blog

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Amazon Com Tax Free Iuls The Perfect Retirement Solution And Pathway To Financial Security With A Tax Free Income You Won T Outlive 2014 Edition Ebook Cox Bruce E Kindle Store

Tax Credits For Homeowners Homeowner Tax Deductions Explained

Making Your Home Mortgage Tax Deductible Purtzki Johansen Associates

Record Keeping Tips For Tax Season Hubpages

Mortgage Payment Calculator With Pmi Taxes Insurance Hoa Dues Mortgage Rates Mortgage News And Strategy The Mortgage Reports

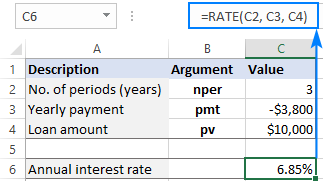

Using Rate Function In Excel To Calculate Interest Rate

How Much Mortgage Interest Is Tax Deductible

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Mortgage Payment Tax Calculator Deduction Calculator